Exclusive Free Tax Filing for Full-Time FERS Employees!

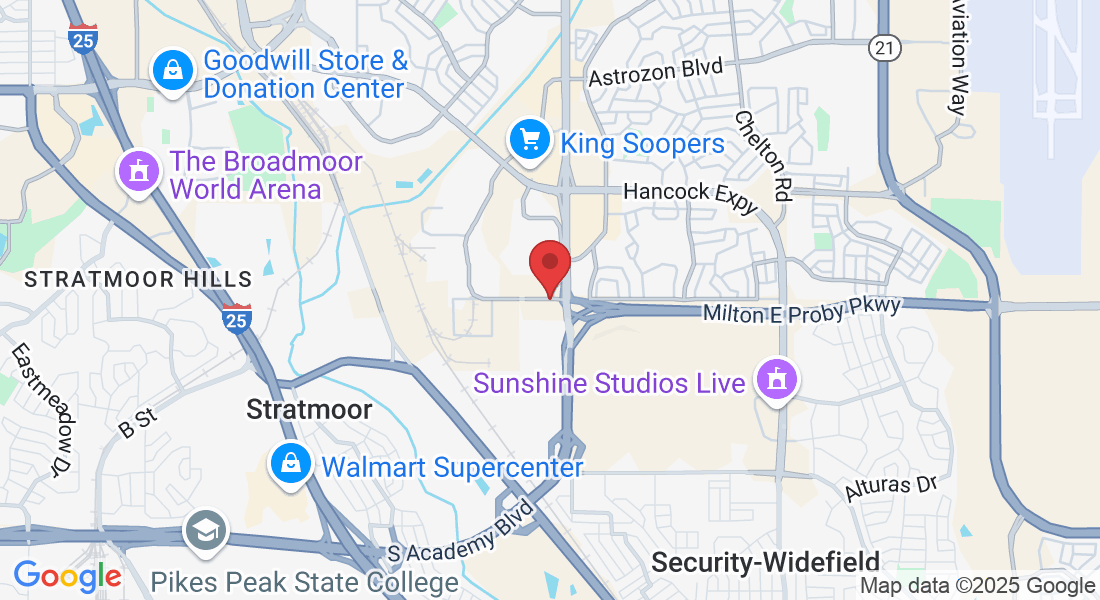

If you're a FERS employee, we’re offering Free Federal and State tax prep & e-filing —at no cost to you. AFBN has served the Fort Carson for over 15 years!

Contact an Armed Forces Benefits Network tax specialist today at

(719) 838-5708, or fill out the form below to schedule your appointment!

Meet a few of our Professionals

Katarina Echeverria

Army Spouse

Ron Pettigrew

Retired US Air Force

Ryveal McIver

Army Reservist

Brittany Zier

Above and Beyond

Dylan Biggs,

Army Veteran

FAQS

Can I get my taxes done for free?

Yes. If you are currently a full time FERS employee one of our qualified representatives will prepare and e-file your Federal and State Taxes free of charge. There is no cost or obligation since we provide this service as a way of giving back we cannot accommodate complex or corporate returns which require a CPA or Tax Attorney however the vast majority of returns is easy and convenient.

How do you ensure the accuracy of my tax return?

Our certified financial specialists, with decades of experience working with federal employees, follow a detailed process to ensure accurate and compliant tax filings. We carefully review all provided materials and stay current with tax laws. If the IRS or State adjusts your return due to errors or omissions, you are responsible for the correct taxes or credits. However, AFBN will cover any interest and penalties up until the due date for the first notice of additional taxes, interest, or penalties.

How soon can I file and get my refund?

You can file your tax return as early as the first week of January if you have a basic return and choose to e-file. However, the timing of your refund depends on the IRS processing schedule, which is scheduled to start on January 27, 2025. Once your return has been submitted to the IRS, its up to them as to when it will be processed, typically the earlier you file the more quickly you will get your refund. Most tax refunds are issued within 21 days but it is possible for your return to take longer. To check on the status of your tax return visit IRS.gov. AFBN is not notified when a tax return will be processed.

How long will it take to file my taxes?

To ensure a quick and seamless process, please bring all the necessary paperwork to your appointment, including W-2(s), SSN(s), 1098, 1099, records of other income (such as rental, jury duty, gambling), employment-related expenses (like dues, travel, tolls, uniform costs, and cleaning), and any other required tax documents (a full list is available at AFBN.us). In addition to providing free tax services, we will also educate you on ways to reduce your tax liability, plan for future taxes, optimize your military benefits, and build wealth. Our goal is to help you feel well-prepared and informed.

While most tax returns can be completed in under 60 minutes, please plan for your appointment to last up to 2 hours.

Can my spouse file for me?

No - all parties represented on a tax return must be present at the the appointment. Since service members have 180 days to file after returning to CONUS from an overseas deployment, AFBN does not prepare taxes via Power of Attorney (POA) without the service member being present. We require your physical presence to ensure accurate and compliant tax preparation.

© 2024 Armed Forces Benefits Network | All Rights Reserved - Official Contest Rules